Page 11 - CMA Journal (Nov-Dec 2025)

P. 11

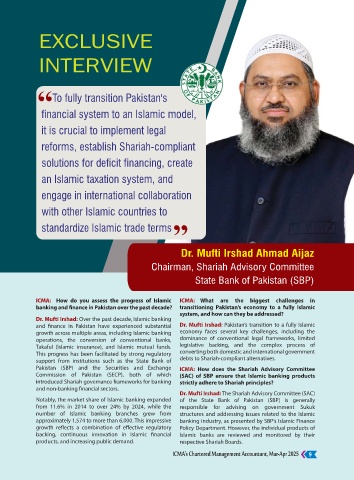

Exclusive Interview

This shift is essential because:

1) Pakistan needs USD 40–50 billion annually for Pakistan must end unsafe

adaptation.

construction and enforce

2) International climate finance is loan-heavy, complex,

and slow. climate-resilient land-use

3) Dependence on global funds alone is no longer planning. The catastrophic 2022

viable.

Public-private models that combine risk-sharing, digital floods exposed how fragile and

tools, and transparency are now central to scaling poorly located structures

adaptation efforts.

ICMA: How can early warning systems be strength- collapsed within moments

ened so communities are better prepared before

disasters strike?

Sherry Rehman: Pakistan’s geography makes early

warning a matter of survival. Our land mass contains The federal planning process remains entangled in

13,032 glaciers, the highest number outside the polar numerous aging projects that have not been financed,

regions, and 3,044 glacial lakes, at least 33 of which are yet are still included in the PSDP planning, complicating

classified as dangerous. These pose a risk to 2 million integration with provincial needs. The Water Ministry

people downstream, including 800,000 in immediate remains under-leveraged, even as Pakistan’s water crisis

danger. intensifies, and water planning cannot be separated

The current early warning landscape is still suboptimal. from climate or environmental planning across sectors.

Despite investments, many warnings remain informal and This situation must change.

arbitrary — in one instance, a shepherd alerted ICMA: How can businesses play a real role in climate

communities of an incoming GLOF. Glacier water mass has action while supporting local communities?

declined by 16% in just a few years, and each lake burst

due to high temperatures wreaks havoc, destroying Sherry Rehman: Businesses have a decisive role in

livelihoods and infrastructure, including bridges, within Pakistan’s climate response because every industry

minutes. People in the path of such calamities require depends on energy, water, and stable supply chains, all

upgraded and reliable warning systems. of which are increasingly disrupted by climate change.

Corporate climate action must therefore become a core

Even for river overflows, digital early warning systems

business strategy, focused on adaptation, mitigation,

can evacuate up to 90% of at-risk populations. The path

governance, and accountability.

forward involves integrating AI, satellites, sensors, and

community evacuation protocols, especially since the First, corporate adaptation is essential for business

UN recognizes early warning as a human right. Pakistan survival and community resilience. Companies must

must coordinate agencies like PMD, NDMA, and the prepare for climate shocks such as extreme weather,

Flood Commission with private-sector weather resource scarcity, and supply chain disruptions by

forecasting entities for timely and effective warnings. investing in resilient infrastructure, climate-smart supply

chains, and resource-efficient technologies. These

ICMA: Each province faces unique climate

investments reduce operational risks, protect jobs, and

challenges. How can Pakistan build a coordinated,

ensure continuity for communities that rely on local

resilient response?

industries and services.

Sherry Rehman: While provinces have developed

Second, mitigation efforts are equally critical and

tailored strategies, especially in health, climate policies

commercially viable. Reducing the environmental

are rarely explicitly integrated, despite their clear

footprint of business operations through renewable

adaptation benefits.

energy adoption, energy efficiency, cleaner production

A coordinated response requires federal-provincial technologies, and circular economy principles directly

alignment through shared data, GIS-based catastrophe supports emissions reduction while lowering costs over

modelling, common screening standards, and time. Transitioning away from high-emission

harmonized project pipelines, ensuring that local practices—particularly in energy-intensive sectors such

priorities feed into national resilience planning rather as cement and fertiliser, as emphasised in Pakistan’s

than compete with it. Nationally Determined Contributions (NDCs).

ICMA’s Chartered Management Accountant, Nov-Dec 2025 9