Page 46 - CMA Journal (Nov-Dec 2025)

P. 46

Focus Section

Policy Coherence, Fiscal Instability, and Lack operational. In an effort to fill this gap and to shift the

of Private Sector Contribution focus of policy articulation and continued climate

change, it is important to note that the following

Climate finance requires long-term policy stability that is

institutional reforms are required for immediate

lacking in Pakistan's unstable political economy.

adoption in Pakistan:

• Unpredictable Policy Signals: A high turnover of

Centralized Authority: One entity that has the

regulatory reversals, including sudden changes to

enforcement capacity to combine NCFS goals and

renewable energy tariffs or EV component import

PGT qualifications across all concerned ministries,

quotas, contradicts the purpose of the Green/Amber

the State Bank, and provincial governments.

categories of the PGT and the NCFS's mobilization of

private capital. It has also eroded investor Fiscal Integration: Requirement of PC-1 and Public

confidence, making regulatory risk higher than the Sector Development Program (PSDP) appraisal

climate opportunity. systems to have DNSH, emissions thresholds, and

green impact indicators as hard requirements.

• Absence of Incentives: Although the private sector

is showing interest in making PGT-aligned Incentives: Implement short-term, physical rewards,

investments, it complains that the government is not e.g., tax credits, concessional lines of credit, and

providing any tangible support. More importantly, preferential government procurement of

No Rewards to Compliance- no major tax breaks, investments that meet verifiable PGT-compatible

special offerings of lines of credit, or blended-finance status.

packages to go hand in hand with PGT alignment.

Capacity Building: Establish specific technical units

This has created a high technical barrier and a low

within provincial planning departments and train

financial incentive, threatening to keep the green

municipal authorities to incorporate PGT tools into

transition an elite project rather than an

district-level planning and to conduct proper project

economy-wide change. The investors fear that the

screening.

green label is cosmetic, lacking firm verification and

effective regulators. This alienation threatens to turn Credibility of Data: Complete operationalization of

the green transition into an elite, business-level the National Climate Finance Portal by providing

6

effort- and not an economy-wide one . transaction-level, verifiable disclosure systems and

developing a procedure on how to accredit the

The operational discrepancy between the strategic

third-party verifiers and auditors to enhance the

objectives of the NCFS and the technical needs of the

credibility of green-labelling and reduce market

PGT can be summarized in the table below, which

illustrates the specific institutional voids to be bridged 5,6. doubts about greenwashing.

Reference:

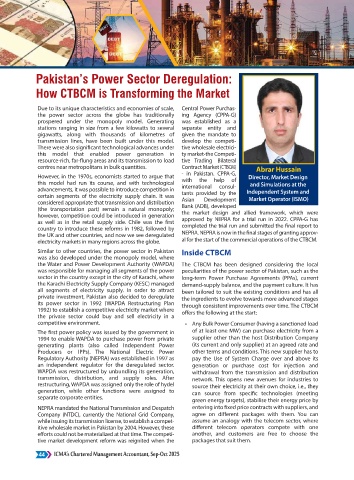

NCFS Strategic Goal

Scaling Investments (Innovative [1]. MOCC. Gov.Pk (2025). https://mocc.gov.pk/NewsDetail/OTll

Instruments) Policy Outcome/Risk NzdmOWMtMDA1Ni00Mjk0LWIwYWItODA2MTU2NDkxYjkz

Strengthening Governance Greenwashing risk; investor [2]. Germanwatch. Climate Risk Index 2026: Who suffers most from extreme weather

(Coordination, Portal) Key Institutional and paralysis; over-reliance on

Enhancing Sectoral Resilience (NDCs) Operational Gap Amber (Transition) projects. events? Weather-related loss events in 2023 and 1993–2023. Bonn: Germanwatch

Inconsistent Policy Signals and

M&E and Transparency Implementation vacuum; e.V.; 2025. https://www.germanwatch.org/sites/default/files/2025-11/

a lack of immediate financial slow project approvals;

rewards for PGT adherence. CRI%2026%20full%20report.pdf

regulatory overlap between

Fragmentation and Federal- SBP and provincial EPAs. [3]. National Climate Finance Strategy of Pakistan- 2024 https://mocc.gov.pk/

Provincial Disconnect.

Weak, non-compliant project SiteImage/Misc/files/NCFS.pdf

Capacity Deficit in district proposals; DDB financing is

planning, green engineering, constrained; inability to [4]. Pakistan Green Taxonomy 2025 https://mocc.gov.pk/SiteImage/Misc/files/Draft_

PGT Operational Necessity and environmental accounting.

Market Confidence & Regulatory Data Deficiencies: Existing effectively track Pakistan_Green_Taxonomy_Feb2025.pdf

Environmental Outcomes.

Stability (Green/ Amber Classifications) C-PIMA and public sector Neutralization of NCFS's [5]. Salik, M. A. N. (2025, March 24). Pakistan’s National Green Taxonomy: Framework

Uniform Application of SC & DNSH monitoring lack the necessary positive impact; high and integration (N. Nigar, Ed.). Institute of Strategic Studies, Islamabad.

(Enforcement Power) rigor and completeness for perceived risk; failure to

Local-Level Technical Capacity investor verification. meet NDCs on an auditable https://issi.org.pk/wp-content/uploads/2025/03/IB_Salik_March_24_2025.pdf

(Screening & Reporting) basis. [6]. Majeed, Z. (2022). Climate finance: Challenges, opportunities, and way forward

Credible, Real-time Data (Transaction- for Pakistan (MPhil thesis, Pakistan Institute of Development Economics).

level visibility)

https://file-thesis.pide.org.pk/pdf/mphil-environmental-economics-2019-zahid-maje

Figure 2: Analytical Framework of NCFS-PGT Misalignment and Policy Risk ed--climate-finance-challenges-opportunities-and-way-forward-for-pakistan.pdf

[7]. BR Research. (2025, March 6). Pakistan green taxonomy: A game changer or just

4. Recommendations greenwashing? Business Recorder. https://www.brecorder.com/news/40351539

Figure source:

The National Climate Finance Strategy and Green Figure 1: [2]

Figure 2 [Author]

Taxonomy of Pakistan can be considered as a sound

foundation for climate finance and development. The About the Author: Dr. Azeema Begum holds a PhD in Economics

structures are not necessarily flawed, but are designed as and has authored over 23 published articles and presented more

than 15 research papers at international and national conferences.

whole systems facing a sequence of crucial governance

With eight years of diverse research experience across multiple

and capacity challenges. The correspondence between organizations, she currently serves as Assistant Manager, Research

NCFS and PGT is at present only aspirational rather than and Publication, at Saviours.

44 ICMA’s Chartered Management Accountant, Nov-Dec 2025